Membership Onboarding

Membership Made Easy with No Joining Fee!

We've removed our joining fee so you can become part of a community that has provided ethical, fair, and affordable financial services for over 25 years. Simply downloading our mobile app and following the steps, we're offering you a quick and convenient way to become a member.

Benefits of Joining

Discover the benefits of joining our Credit Union

How to join?

Join using your phone

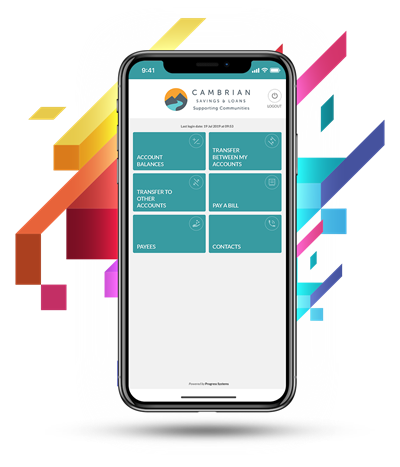

We’ve created an intelligent and secure method for you to become a member directly through your mobile phone. All you have to do is download our Mobile App to take full advantage of joining as you go.

Quick online access

Once your membership has been approved, we'll text you a temporary PIN so you can have immediate access to your online account. You won’t have to worry about anything, we will do the rest.

In order to start your Online Membership journey, you will need to download our Mobile App. Download today and reap the benefits of becoming a member.

How to get started

Download our Mobile App

Make sure you have valid ID ready

Complete the form

Verify your Identity

Upload required documentation

Sit back and wait for us to review and approve your membership

Membership FAQs

Have a question? Check below to see if it is answered in our Frequently Answered Questions.

Download our Mobile App on the App Store or Google Play Store, click the Join button and follow the steps to become a member.

Photographic ID

- Current signed passport – if the passport is not UK/Irish then we will also need to see their Right to work documentation.

- EEA member state identity card (which can also be used as evidence of address if it carries this)

- Current UK or EEA photocard driving licence (Full and Provisional) – the address on the Driving licence must be checked against the record in Progress, if this does not match the Driving licence is not valid.

- Photographic registration cards for self-employed individuals in the construction industry -CIS4

- Firearms or shotgun certificate

- Residence permit issued by the Home Office to EEA nationals on sight of own country passport

- UK Citizen Card

- Armed forces identity card – unexpired

Non-Photographic ID

- Full old-style driving licence – not provisional

- Official letter from Benefits Agency/DWP/Local Authority confirming your right to UK benefits, local benefits, UK Pension - dated within the last 12 months.

- UK Student loan/ grant paperwork – dated in last 12 months

- HMRC coding/assessment/statement/tax credit letter (not P45/P60) (dated within the last 12 months)

Proof Of Address

- Utility bill (gas, electric, satellite television, landline phone bill or broadband bill) dated within the last six months .

- TV licence or confirmation of TV licence renewal letter as long as dated in the last 12 months.

- Water bill dated in the last 12 months.

- Local authority council tax bill for the current council tax year – this must be the bill only not letters relating to the tax.

- Current UK driving licence (but only if not used for the ID evidence)

- Bank, Building Society or Credit card statement or passbook dated within the last three months.

- Original mortgage statement from a recognised lender issued for the last full year.

- Solicitors letter within the last three months confirming recent house purchase or land registry confirmation of address

- Council or housing association rent card or tenancy agreement or Occupation Contract for the current year

- Official letter from Benefits Agency/DWP/Local Authority confirming your right to UK benefits, local benefits, UK Pension - dated within the last 12 months. Only if not used as Proof of ID.

- HMRC self-assessment letters or tax demand dated within the current financial year

- Electoral Register entry

or

NHS Medical card or letter of confirmation from GP’s practice of registration with the surgery – note this is not appointment letters from hospital

- HMRC coding/assessment/statement/tax credit letter (not P45/P60) (dated within the last 12 months) Only if not used as Proof of ID.

- Letter from a Prison Governor or Probation Officer (must be on official headed paper)

- UK Student loan/ grant paperwork – dated in last 12 months

- For Homeless – letter from support/social worker dated in last 3 months

To use our products and services, there is now no joining fee.

Members must maintain a minimum of £5 in their account at all times to keep it active.

A yearly membership fee of £5 is charged on the anniversary of joining. Junior members (Aged up to 15 years) do not pay a membership fee until they become an Adult Member (from 16 years of age)

Deposits can be made via a Payment Link which is sent once the online application is submitted. Standing Order and Benefits are accepted.

For more information of our fees please click on this link

Save as little or as much as you want but accounts can hold a maximum of £85,000.

Yes. As a member of the Government-backed Financial Services Compensation Scheme, your total savings are protected up to the value of £85,000.

Choose from Standing order, Online banking, or through our app. Or why not save directly through you salary through Payroll Savings.

Cambrian Credit Union Limited

Sort Code: 08-92-50

Account Number: 67005527

For your reference please input your Cambrian member number

Transfers are processed at the following times Monday - Friday (Excluding bank holidays)

9.30am, 10:30am, 12:00pm, 2:00pm and 4:00pm.

For example if transfers are received at 10:00am these will be processed at 10.30am. If transfers are received after 4:00pm these will be processed the following day (Excluding bank holidays and weekends)

Warning: Late repayment can cause you serious money problems. For help with your account please contact our team on 0333 2000 601, email info@cambriancu.com or visit https://www.cambriancu.com/contact-us . For financial advice visit www.moneyhelper.org.uk